By John Seevers, Valentine Seevers & Associates | (303) 674-5561 | jseevers@vsaacpa.com | www.vsaacpa.com

Recently enacted tax reform measures in the Tax Cuts and Jobs Act (TCJA) reduce individual and corporate tax rates, eliminate a host of deductions and credits, enhance other breaks and make numerous additional changes, some of which could impact your wealth portfolio.

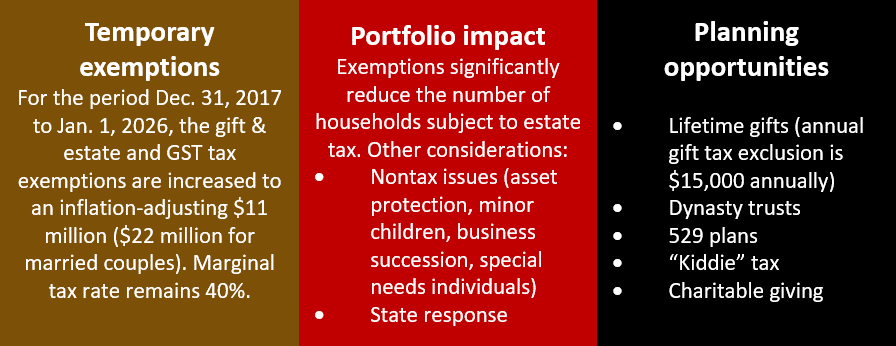

Gifts and estates is one such area. While TCJA doesn’t repeal the federal gift and estate tax, as once proposed, it does temporarily double the combined gift and estate tax exemption and the generation-skipping transfer (GST) tax exemption, creating estate planning opportunities and challenges. You now can take advantage of temporary record-high exemption amounts. But heed the small print; there are changes in the tax law that could trip the unwary in 2018.

Review your Estate Plan

The rules have changed, and your estate plan could now be obsolete. The good news is you have time in 2018 to review your plan and update it to capture the most favorable tax treatment. We’re here to help you evaluate the impact of the new tax law and take advantage of the opportunities now available, while minimizing downsides that could impact your family. Contact us if you would like to review, update or chat about your plan.